State Space Models

Thursday, January 30, 2025

What is Neoliberalism?

Friday, January 17, 2025

World-System (1872-1908) Expanded Outputs of the Classical Model for Germany

Saturday, January 11, 2025

World-System (1872-1908) A Classical Model of German Development

In a prior post (here), I discussed whether we should pay attention to the Classical Economists who wrote in the Nineteenth Century. They had brilliant insights but they lacked the statistical tools to test their ideas. Now that we have the tools and the historical data, there is no reason not to test and extend their ideas. One of the problems is figuring out what the Classics actually meant because their writing was verbose, obscure and difficult for modern readers to wade through.

Benjamin Higgins (1968) (here) has come to our rescue with a book (now out of print but still available used here) that develops a generalized mathematical model of economic development based on the classics (see Chapter 3). He presents eight structural equations (p. 63) and a time plot of the relationship between N (Population) and Q (GDP), above. His Figure 2-3 (above) looks very similar to the time series plot for the German 19th Century model (DEL19) at the beginning of this post which was based on an estimated dynamic state space model. The DEL19 model used the same variables identified by Higgins but did not arrive at the time plot using Higgins classical structural equations. Understanding how the DEL19 model was constructed will help me explain how to approach the Classics with modern tools.

Higgins identifies the following variables as central to the general Classical model: Production (Q), Labor (L), Capital (K), Wages (W), Profits (R), Investment (I) and Technology (T). Variables can be further grouped (using Systems Theory) as system output state O=(L,Q,T), Endogenous (W,R,I), Exogenous (N) and Output (K) yielding the directed graph above (Higgins actual structural equations are presented below in the Notes--the endogenous variables can be reduced out of the equation system).

To Neoclassical Economists, the directed graph will look strange. Technology is usually taken as exogenous and the Capital stock would be included in the system state. But the Classics believed that Technology had to be embedded within investments and the Capital stock. Also, I think some Outputs are missing from Higgin's model (what happened to Adam Smith's Free Market? What happened to Democracy?) but I'll pick up the issue in a future post on the way to dealing with Liberalism and Neoliberalism.

The Classics also struggled with definitional issues. Did Capital include land, machines, buildings, knowledge, etc.? Were wages driven to subsistence in order to increase profits (R = Q - wL) where w is the subsistence wage. How to define Technology (T)? So many questions, so much speculation, so little testing.

Systems Theory avoids these arguments by defining the System State, S = S(Q,L,K,W,R,I,T), as being a function of all the essential variables in a system. The problem then is to estimate a state variable index and other independent indexes that describe Error Correcting Controllers (ECCs) for the system, that is, describe growth and control as two separate issues that have to be estimated separately for the system--allowing that the system might not be under adequate control.

In terms of system behavior, the steady state depicted in the DEL19 Time plot was not the result of the DEL19 BAU model but required input from the World System (see the directed graph above). Understanding that every economy is embedded within the World-System had to wait for the development of World-Systems Theory at the end of the Twentieth Century and the development of Hierarchical Control Systems in the 21st Century.

Summary

- It is not easy to just speculate and try to understand Complex Systems. The systems are Black Boxes that only reveal their behavior by observing inputs and outputs.

- Higgins Classical model (see below) is static whereas writers such as William Baumol (1960) thought the primary attribute of Classical Models were their "Magnificent Dynamics" (download pdf here).

- The Classics were willing to go ahead and speculate without clearly defining their essential variables, for example, Capital and Technology.

- The policy recommendations derived from Classical Models (Population control, Free Markets, Free Trade, Steady States, etc.) were advanced from weak foundations.

- The Classics did not advance ideas about how the Economic System is controlled, aside from free markets. In Germany, the Classical Economy was mostly controlled by Investment relative to population and employment. These two Error Correcting Controllers might be implicit in Classical reasoning but had to wait until a reinterpretation by Systems Theory in the Twentieth Century.

- The concept of the Steady State was dropped in favor of unlimited growth by Neoclassical Economics, but has been revitalized by Ecological Economics. Unfortunately, it is a state that might only be observe in the Future, and the Future is unknowable.

- Linkage to the World System is an important part of German development in the Late Nineteenth Century. Had the link been pursued, rather than World Domination, Germany would have become a stable society in the 20th and 21at Centuries. It would not have pursued the World Wars and the Great Depression would probably not have happened. However, there was no role for the World System in either Classical Economics or Neoclassical economics. World-Systems Theory was based in Classical Marxian Economics but borrowed freely from Neoclassical Economics when needed. There is more work to do in expanding the economic underpinnings of World-Systems Theory and Classical Economics is a good place to start.

Notes

Higgins (1968: 57) defines his Classical Economic System using structural-functional notation. The final equation, W = wL, is the long run constraint that wages are driven to subsistence, w. Structural equations are very important to Academic Economists, but there is a problem. The Cybernetic Theory of Isomorphic Systems proves that structural equations are not unique if two systems have the same time path for the output variables. In other words, The graphics at the beginning of this post look alike but they were generated from two different systems. The first graphic is from a state space model (DEL19W model) and the second from Higgins Classical model.

Classic References

- Adam Smith Wealth of Nations

- Malthus An Essay on the Principal of Population

- Malthus Principles of Political Economy

- Ricardo Collected Works

- Marx Collected Works

- JS Mill Collected Works

- JM Keynes The Collected Writings

Wednesday, January 1, 2025

World-Systems Theory: The Malthusian Controller

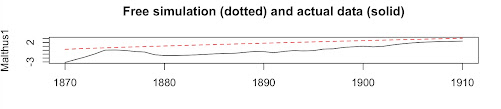

A time plot of Malthus2 (above) shows that right after German Unification in 1872, there was a Malthusian Crisis (QA-N < 0) that ran from Unification until almost 1880. The dashed red line in the graphic above is the attractor path for the Malthusian model, an approximate straight line around (QA-N = 0).

But what about Malthus1 that explains 87% of the variation in Q and N? The graphic above indicates that the Malthusian growth component was underperforming below the attractor path for most of the late 19th Century in Germany. Germany's late and rapid growth and Modernization, thought to be a factor in World War I, was basically a return to the attractor path interrupted by German Unification.